Blended Finance

Welcome to Convergence's blended finance primer. This primer uses Convergence's database of historical blended finance transactions to generate unique insights about the blended finance market to date. Convergence's data methodology can be viewed here.

Definition

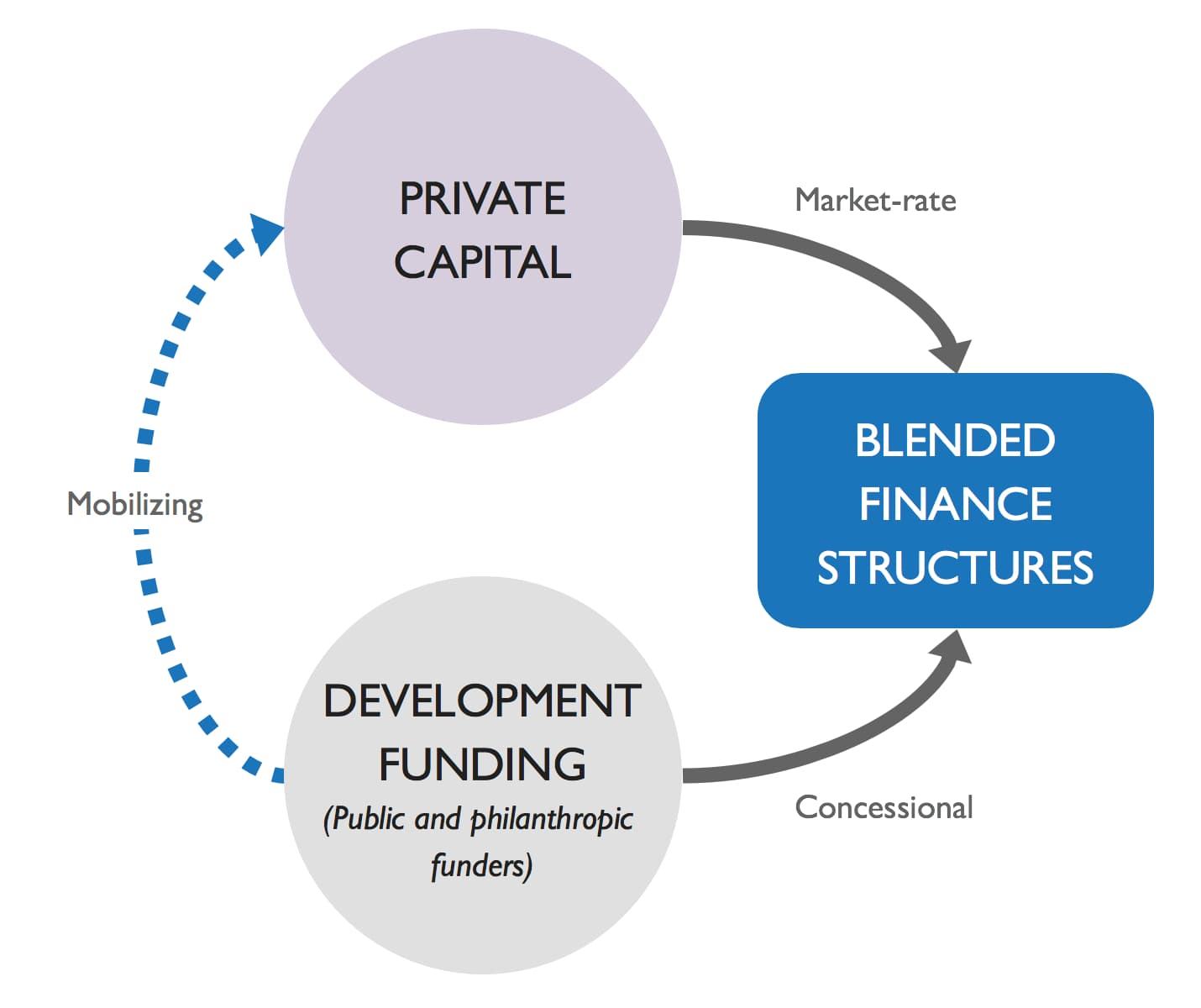

Blended finance is the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development.

Blended finance is a structuring approach that allows organizations with different objectives to invest alongside each other while achieving their own objectives (whether financial return, social impact, or a blend of both). The main investment barriers for private investors addressed by blended finance are (i) high perceived and real risk and (ii) poor returns for the risk relative to comparable investments. Blended finance creates investable opportunities in developing countries which leads to more development impact.

Blended finance is not an investment approach, instrument, or end solution. It is also different from impact investing. Impact investing is an investment approach, and impact investors often participate in blended finance structures.

Convergence focuses on blended finance in developing countries. Developing countries face significant challenges including low levels of access to safe drinking water, sanitation and hygiene; energy poverty; high levels of pollution; high rates of tropical and infectious diseases; and a lack of physical infrastructure. Blended finance can create investment opportunities in developing countries, crowding in additional private sector funds in volumes never before seen.

Convergence focuses on blended finance to catalyze private investment. Other important stakeholders and initiatives, such as the Organization for Economic Co-operation and Development (OECD) and the DFI Working Group on Blended Concessional Finance for Private Sector Projects focus on a broader scope of blended finance that includes the use of development capital to mobilize commercial-development orientated public capital (e.g., capital from development finance institutions). Convergence works closely with the OECD, DFI Working Group, and others to coordinate blended finance activity.

Importance

The Sustainable Development Goals (SDGs) are a set of 17 Global Goals set by the United Nations (UN) that aim to tackle a range of issues, from combating climate change to ending poverty and hunger. Not only do the SDGs aim to create a world that is more sustainable, they also offer real business opportunities.

To achieve the SDGs, a significant scale-up of investment is required today. Current levels of development financing are not sufficient, with an estimated $4.2 trillion funding gap per annum to realize the SDGs in developing countries alone.

Blended finance is one critical approach to mobilize new sources of capital for the SDGs, however it can only address a subset of SDG targets that are investable. For example, blended finance is highly aligned with goals such as Goal 8 (Decent Work and Economic Growth) and Goal 13 (Climate Action), while less aligned with SDGs such as Goal 16 (Peace, Justice and Strong Institutions).

Characteristics

Blended finance transactions should have three signature characteristics:

- The transaction contributes towards achieving the SDGs. However, not every participant needs to have that development objective. Private investors in a blended finance structure may simply be seeking a market-rate financial return.

- Overall, the transaction expects to yield a positive financial return. Different investors in a blended finance structure will have different return expectations, ranging from concessional to market-rate.

- The public and/or philanthropic parties are catalytic. The participation from these parties improves the risk/return profile of the transaction in order to attract participation from the private sector.

Archetypes

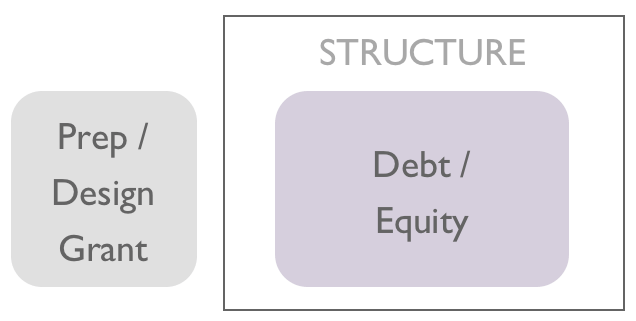

Blended finance is a structuring approach. Blended finance is not an investment approach, instrument, or end solution. Convergence identifies four common blended finance structures:

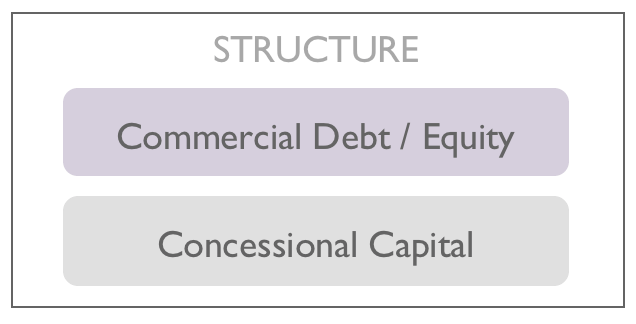

Public or philanthropic investors provide funds on below-market terms within the capital structure to lower the overall cost of capital or to provide an additional layer of protection to private investors (referred to as concessional capital in this primer).

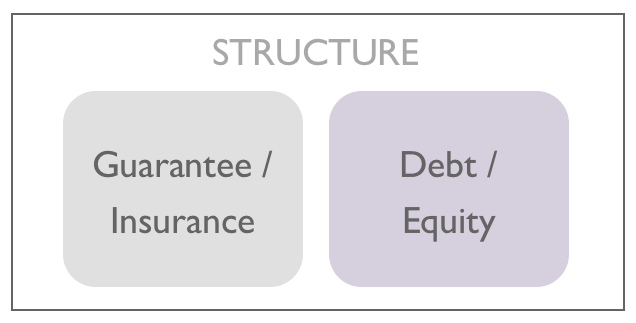

Public or philanthropic investors provide credit enhancement through guarantees or insurance on below-market terms (referred to as guarantee / risk insurance in this primer).

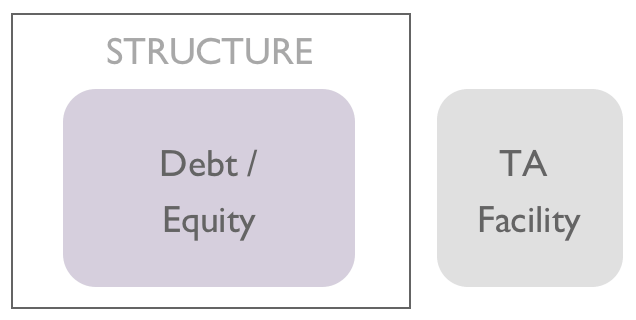

Transaction is associated with a grant-funded technical assistance facility that can be utilized pre- or post-investment to strengthen commercial viability and developmental impact (referred to as technical assistance funds in this primer).

Transaction design or preparation is grant funded (including project preparation or design-stage grants) (referred to as design-stage grants in this primer).

Market Size

Blended finance has mobilized approximately $268 billion in capital towards sustainable development in developing countries to-date. Convergence has identified approximately 6,800 financial commitments to these blended finance transactions.

Convergence curates and maintains the largest and most detailed database of historical blended finance transactions to help build the evidence base for blended finance. Given the current state of information reporting and sharing, it is not possible for this database to be fully comprehensive, but it is the best repository globally to understand blended finance scale and trends. Convergence continues to build out this database to draw better insights about the market and disseminates this information to the development and finance communities to improve the efficiency and effectiveness of blended finance to achieve the SDGs.

Deal Sizes and Types

Blended finance transactions range considerably in size, from a minimum of $110,000 to a maximum of $8 billion. The median blended finance transaction has been $64 million in total size (2010-2018).

Funds (e.g., equity funds, debt funds, and funds-of-funds) have consistently accounted for the largest share of blended finance transactions, although we have seen more diversification across transaction types in recent years.

Blending Trends

Concessional debt or equity has been the most common archetype, including first-loss debt or equity, investment-stage grants, and debt or equity that bears risk at below-market financial returns to mobilize private sector investment. There has been an increase in the use of both concessional debt or equity and guarantees or risk insurance in recent years.

Regions

Sub-Saharan Africa has been the most frequently targeted region in blended finance transactions. In recent years, we’ve seen Asia and Latin America emerge as new frontiers for blended finance.

Sectors

Financial Services has been the most frequently targeted sector in blended finance transactions, followed by Energy. Generalist structures targeting multiple segments have also been common.

SDGs and Impact

Goal 17 (Partnerships for the Goals), Goal 08 (Decent Work & Economic Growth), Goal 09 (Industry, Innovation, & Infrastructure), and Goal 01 (No Poverty) have been the most frequently targeted in blended finance transactions.

Investors

In the database, over 2380 unique investors have participated in one or more blended finance transactions.

Nearly 2/3 of blended finance investors come from the private sector.

~20% investors have participated in three or more blended finance transactions. The majority of investors have only participated in one blended finance transaction.

Private Investors

The most active private investors in blended finance have included Ceniarth LLC, Standard Chartered Bank (StanChart), Calvert Impact Capital, Mitsubishi UFJ Financial Group (MUFG), and Sumitomo Mitsui Banking Corporation. Many of the most active private investors have an explicit impact-mandate, either as a whole or the specific branch/unit with the relevant focus (e.g., sustainable finance).

Public Investors with a Development Mandate

The most active public investors with a development mandate include development agencies and multi-donor funds like USAID and GuarantCo. These parties have participated in about half of all blended transactions and provide funding to blended transactions both directly and indirectly through their contributions to multilateral organizations, MDBs, DFIs, funds, and programs.

Public Investors with a Commercial Mandate

The most active public investors with a commercial mandate include Multilateral Development Banks (MDBs) and Development Finance Institutions (DFIs). MDBs and DFIs participate in blended finance transactions as i) providers of commercial capital, and to a lesser extent, as ii) providers of concessional capital, which they source from specific pools of donor funding (i.e., through the indirect blending activities of donor governments).

Philanthropic Investors

The most active philanthropic investors in blended finance have included Shell Foundation, Gates Foundation, Oikocredit, and Omidyar Network.

Learn More

Convergence members have access to:

- Detailed information for each blended finance transactions in the database.

- Detailed information on active investors in blended finance and their investment trends.

- Additional insights and analysis for specific investors, blending archetypes, SDGs, sectors, and regions.

- In-depth case studies for select transactions, describing the design process, structure, impact to-date, and summary learnings.

- Trend briefs and other research on the blended finance market.

- A range of additional products and services.

Learn more about Convergence membership here.