More than 40% of blended finance transactions use concessional capital in a junior position to mobilize additional private investment to developing countries aligned to the Sustainable Development Goals (SDGs). Leverage ratio measures the amount of commercial capital mobilized by concessional capital, where commercial capital includes capital deployed by private investors at market rates as well as by public and philanthropic investors (mostly DFIs & MDBs) at market rates.

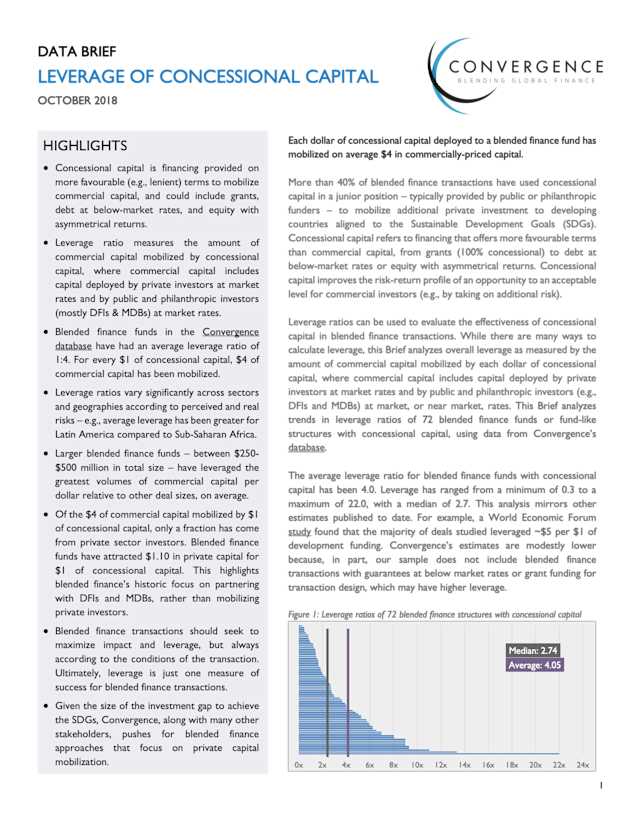

Convergence's new Data Brief analyzes trends in leverage ratios of 72 blended finance funds (or fund-like structures) with concessional capital, using data from Convergence’s database. Leverage ratios vary significantly across target sectors, regions, deal sizes, and structures according to perceived and real risks for commercial investors. On average, blended finance funds have leveraged $4.10 of commercial capital for every dollar of concessional capital. However, only a fraction of this commercial capital comes from private sector investors.

This webinar will focus on key trends and benchmarks for leveraging concessional capital, with the intention of fostering conversation among Convergence’s community of blended finance practitioners on the use of leverage ratios as an indicator of success for blended finance transactions, as well as the opportunities and limitations that blended finance presents.