By Simon Bessant, Director, Texel

Executive Summary

UNCTAD estimates the investment gap in Emerging Markets and Development Economies (EMDEs) to achieve the Sustainable Development Goals and Paris Agreement objectives at $3.5 trillion per annum. To even get close to this number, we’ll need the private sector. However, they are often hesitant to invest in EMDEs due to higher real and perceived risk. At the same time, the global insurance sector has considerable risk bearing capacity, but is systemically under-invested in EMDEs. This article identifies the best ways for the insurance sector to participate in EMDEs, namely through blended finance transactions, to significantly increase investments towards the Sustainable Development Goals.

The benefit of the insurance sector for EMDEs

Insurance has been a critical enabler towards achieving the SDGs across a broad range of areas, such as climate, natural catastrophe, health, longevity, gender, and inequality. Globally, there is a substantial insurance protection gap; the costs for natural disasters regularly range between US$100-200bn annually, but only a fraction of such losses are properly insured. These problems are most acute in EMDEs with lower insurance penetration, ranging from individual citizens up to central governments.

When it comes to the specific area of cross-border trade and the need to scale investment in EMDEs to meet the SDGs, insurance is a critical enabler underpinning many large cross-border investments and trade flows. With high country risk and high project/borrower credit risk precluding most investors from putting capital into developing countries – whereby a full 88% of EMDEs are classified as sub-investment grade, including 76% rated “B” or lower – risk-mitigating instruments such as insurance are crucial to adjusting the risk-return profile of transactions such that private investors can enter developing countries. In addition to private investors, Multilateral Development Banks (MDBs) and Development Finance Institutions (DFIs) are increasingly looking to benefit from insurance products to bolster their balance sheets, and increase their lending appetite. Despite these benefits, the role that insurance plays remains poorly understood.

Providers of insurance and guarantees

While guarantees have become commonplace as a development tool to catalyse private investment to EMDEs by improving the risk-return profile for private investors, insurance has been significantly underused in the blended finance market. Convergence’s Historical Deals Database (HDD) finds that around 27.5% of blended finance transactions have benefitted from guarantees or insurance – but only 2.5% of those deals have benefitted from insurance. Guarantees have been provided predominantly by public sector organizations; development agencies account for 43% of guarantee issuance on concessional terms (e.g., development guarantees) and MDBs and DFIs account for 44%. Insurance products have also been dominated by public sector organizations, such as Export Credit Agencies and specialized multilateral insurance agencies (notably the World Bank’s MIGA). Convergence’s data finds that a mere 7% of insurance and guarantee products have been provided by commercial private-sector insurers. These numbers are likely due to two factors:

Firstly, the high risk facing private commercial insurers, as indicated earlier, hinders the amount of insurance capacity they can offer; insurers are already providing significant amounts of insurance capacity to supporting development finance in EMDE’s with single transaction exposure to single B rated sovereigns often exceeding US$300m per transaction. Moreover, transaction-size poses an issue, whereby transactions are smaller, non-sovereign or at the earlier end of the project development cycle. A clear challenge is how the insurance market can expand its risk-taking capabilities both in size and in underlying risk profile.

Secondly, there is likely under-reporting in private sector participation, given the confidential undisclosed nature of insurance products which are used at scale by financial institutions to support their exposures to EMDEs but rarely disclosed. The IACPM/ITFA Private Credit Risk Insurance Survey 2021 noted that of the 52 respondents to the survey (including 48 commercial banks and 4 development banks/similar) a total of over $135bn of non-payment insurance was purchased in 2021, which facilitated $346.2bn of transactional lending, globally.

Insurance and MDBs and DFIs

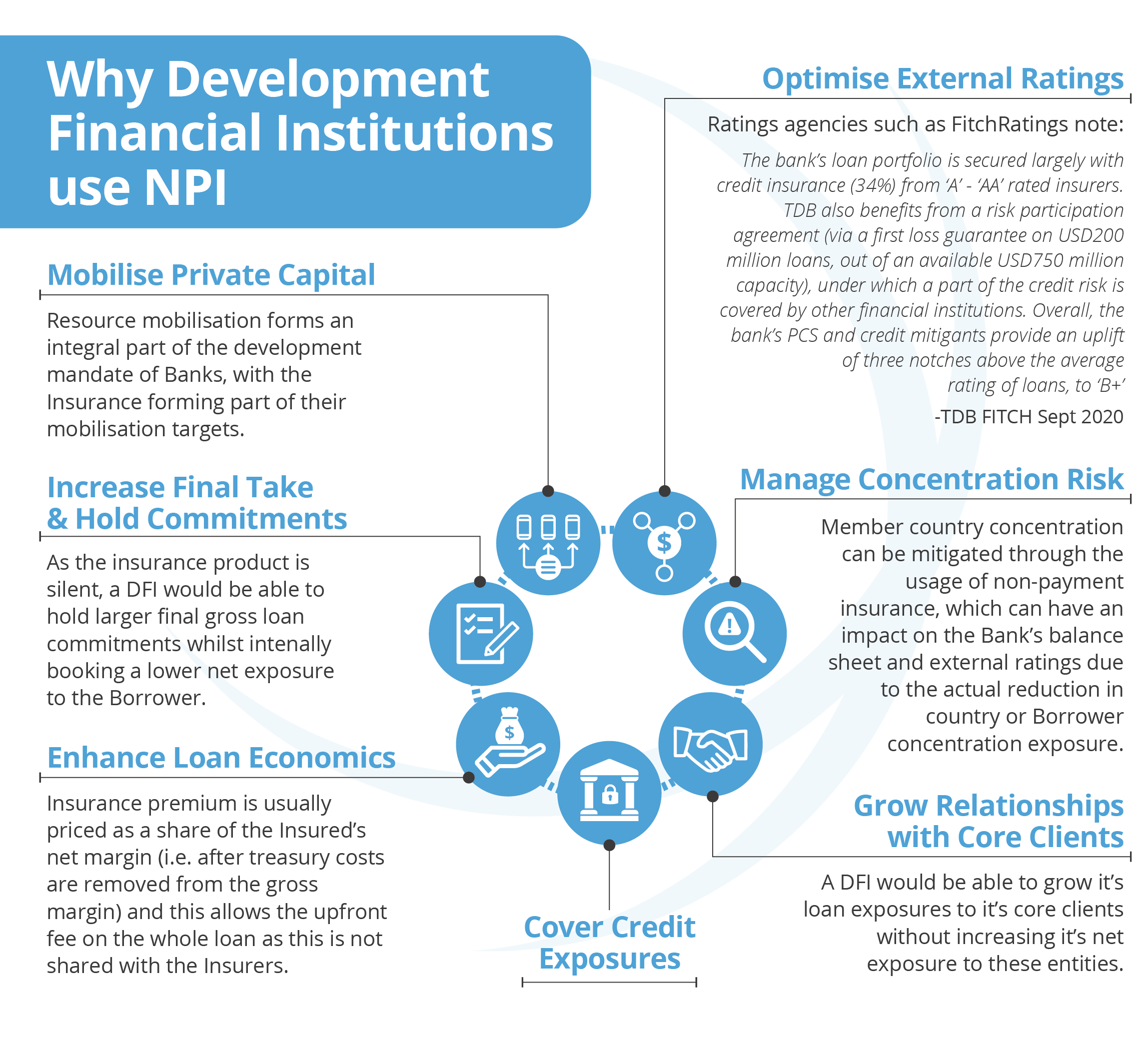

One opportunity for the insurance sector to work more in developing markets is in collaboration with MDBs and DFIs. On the one-hand, MDBs and DFIs are looking for strategies to increase their lending capabilities and optimize their balance sheets, given their conservative risk profiles and capital adequacy limits. In this way, insurance products, including non-payment insurance (NPI), can enable MDBs and DFIs to manage their capital limits more effectively. NPI allows for credit substitution (with an insurer’s rating is substituted for that of the borrower) and is recognized under Basel III banking and Solvency II regulations. Non-payment insurance is increasingly critical – albeit generally non-disclosed and therefore unseen – ingredient underpinning cross-border loans. Non-payment insurance can be arranged on individual loans or on portfolios of obligations, whether on a quota share (pari passu risk sharing) basis or via synthetic risk transfer structures (utilising layers of insurance protection).

Source: Texel, Development Finance Institutions Report, April 2022

Source: Texel, Development Finance Institutions Report, April 2022

In turn, the commercial insurance market is increasingly interested in working with MDBs and DFIs given their low loss history. MDBs and DFIs are seen as having patient capital, and are long-term partners who have a better understanding of the challenges when operating in developing countries, which means insurance isn’t the first consideration should the underlying loan default. Data gathered by Texel demonstrates that the interest from the commercial insurance industry is high; 94% of surveyed insurers aim to increase their level of support for DFIs.

Source: Texel, Development Finance Institutions Report, April 2022

Source: Texel, Development Finance Institutions Report, April 2022

A recent survey of the insurance market highlighted the high level of interest insurers have in collaborating with DFIs, with Ian Nunn, Axa XL’s Head of UK & Lloyd’s Political Risk, Credit & Bond stating:

“Supporting DFIs and Multilaterals with the provision of political risk and credit insurance is integral to AXA’s Purpose: to act for human progress by protection what matters… DFIs and Multilaterals have a critical role to place in closing the infrastructure gap and driving the ESG agenda. AXA Xl is committed to assisting our partners in achieving their objectives, by leveraging their impact and deepening their reach.”

The addition of blended finance, including first-loss capital provided by donor governments, can further enhance the risk-taking capabilities of MDBs and DFIs. Consider the following Room2Run transaction, whereby the African Development Bank (AfDB) transferred the risk on a $2 billion portfolio of loans to a group of London-based insurers and the UK FCDO. The insurance market, namely AXA XL, Axis Specialty, and HDI Specialty is taking on a $400 million first loss tranche, while the UK FCDO is providing a further $1.6 billion of cover, on a second-loss basis, on the same subset portfolio of loans. The Room2Run transaction, brokered by Texel, is an example of the balance sheet optimization objectives of AfDB and how the insurance sector can support private sector mobilization through blended finance.

Insurers do not work in a vacuum. Ultimately the insurance market is a secondary market and insurers rarely originate risks. Therefore, they must work in conjunction with high quality originators of assets (in particular international lenders and DFIs) as well as larger corporates and private equity investors.

How to increase insurance sector coverage and investment in EMDEs, at scale

Data is clearly an important part of any commercial insurance underwriting process. It is also notable that the data available to support credit, project, and political risk analysis in EMDE’s is often less than perfect. Many of the MDBs and DFIs contribute to the GEMs Database, which could provide the wider blended finance and commercial insurance industry with additional datasets that may increase their risk-taking capacities. If the private insurance market participants became members of the GEMs project, they have the potential to help to enrich the data further whilst also allowing a wider sharing of data to those entities tasked with contributing to the scaling of lending into EMDE’s.

Finally, there are also a number of large private insurers who don’t participate in underwriting the bespoke credit and political risk insurance that is so important to increasing the scale of investment in EMDEs. This is generally considered a highly-specialised and longer-tail class of insurance, and the headline risk of underwriting portfolios of risk in far-flung parts of the world is evidently not something that all boards or shareholders can stomach. Greater engagement and recognition in supporting this important area of the insurance market from regulators would certainly be beneficial in this respect, as well as the commercial insurers themselves elevating their own profile rather than tending to operate under the radar. Organisations such as the Berne Union, the global association for the export credit and investment insurance industry, have a role to play here in championing both their public and private members.

Source: A2Z Risk Services Ltd et al. “Claims Made by Regulated Financial Institutions where Insurer Contractual Liability are in Calendar year 2021”

Source: A2Z Risk Services Ltd et al. “Claims Made by Regulated Financial Institutions where Insurer Contractual Liability are in Calendar year 2021”

How to scale up the issuance of insurance to increase SDG and Climate investment in EMDEs

Two concrete actions should be taken by the official development finance sector to boost SDG and climate investment though insurance. First, shareholders of MDBs and DFIs should govern them to increase (i) the aggregate amount of debt and equity they arrange and underwrite and (ii) distribute this primary risk to private sector investors – both funded investors and the insurance sector. Insurance coverage to MDBs and DFIs is a huge benefit given their very low cost of capital. Second, donors should engage directly with the insurance sector to collaborate on blended finance structures that will boost the availability of insurance coverage to financial arrangers arranging debt in EMDEs, such as MDBs, DFIs and commercial banks – a smart insurance blended finance vehicle can materially boost risk capacity for arrangers to significantly increase debt investment in EMDEs. The insurance sector stands ready to contribute meaningfully to the SDGs and 2015 Paris Agreement objectives, and the development finance community should maximise their potential support.

Finally, insurers should also disclose their risk-taking capacities. Rather than having the product remaining confidential and undisclosed, better disclosure would enhance the market’s capacity to scale up its participation in these transactions as well as regulatory profile. Structural protections can be put in place to ensure that transactions which benefit from insurance protection are not negatively selected from a payment or risk perspective, but the disclosure of support from market participants such as Lloyd’s of London syndicates should help to scale financing to support SDG and climate investments in the EMDEs.