Development Finance Institutions (DFIs) are one of the most important sources of financing in developing countries and play an important role in blended finance. They are specialized development banks set up by governments to support the public and private sectors. DFIs can be bilateral, serving to implement their government’s foreign development and cooperation policy (e.g. Dutch FMO), or multilateral, backed by multiple governments to serve one or multiple regions. Some DFIs – like the International Finance Corporation (IFC) – are focused solely on investing in private enterprises in emerging markets (generally referred to as “private sector development”).

DFIs have historically played two main roles in blended finance transactions:

-

As commercial investors: DFIs provide the majority of commercially-priced (or near commercially-priced) capital into blended finance transactions. In a typical blended finance fund one dollar of concessional capital leverages four dollars of commercial capital, three of those four dollars are invested by DFIs.

-

Blending donor funding with their own commercial capital: DFIs raise concessional funding from donors (typically government development agencies), which is blended with their own capital, to invest on below market terms to reach companies and projects they typically do not support.

Activity in blended finance transactions

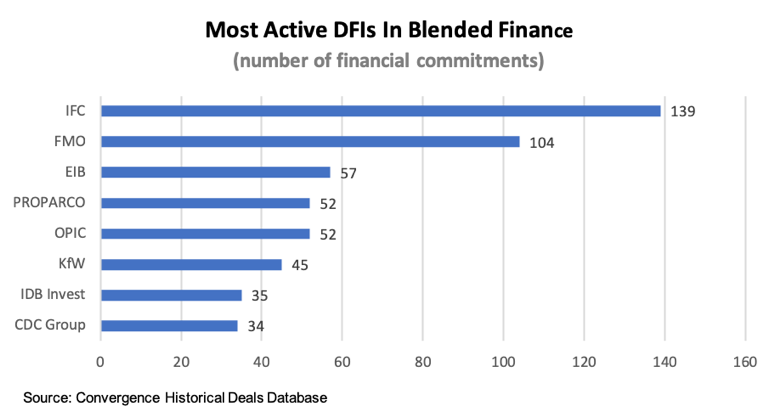

According to Convergence’s database of historical blended finance transactions, the most active DFIs (measured by frequency of appearance in transactions) in blended finance have been IFC, FMO, European Investment Bank (EIB), France’s PROPARCO, United States’ OPIC, and Germany’s KfW. Unlike most DFIs, FMO has shown the greatest propensity to deploy capital at below market rates to attract additional private capital.

As blended finance increases in importance on the global development financing agenda, the largest DFIs, as part of the DFI Working Group on Blended Finance led by IFC, recently refreshed their principles for combining concessional donor funding alongside their own/other investor’s commercial finance. These new principles signal their commitment to ensuring the effective and efficient use of concessional resources in blended finance transactions.

Expanding DFIs catalytic role in blended finance

DFIs are uniquely positioned to originate, structure, and manage sustainable development assets in developing countries. There are few financial institutions that have as much reach, financial capacity, and expertise in these markets. We believe DFIs must play a greater role in attracting private investment, through syndication, securitizaton, or other means. Further, wherever possible, DFI capital should deployed catalytically to attract private investment. This is the case in recent blended finance transactions by IFC and African Development Bank (AfDB):

IFC’s Managed Co-Lending Portfolio Program (MCPP) Infrastructure is a syndications platform that creates diversified portfolios of developing country loans that allow institutional investors to increase their exposure to this asset class. As of 2019, the MCPP-Infrastructure platform has raised $1.5 billion from three large investors including Allianz Global Investors, AXA, and Prudential.

This transaction has commercial investors in a senior position with IFC providing credit enhancement through a first-loss tranche. To make this happen, IFC partnered with the Swedish International Development Cooperation Agency (Sida) who provided a guarantee on a portion of IFC’s first loss, which improved the risk-return profile of IFC’s investment. In turn, IFC’s participation in the first loss tranche provided a more attractive risk-return profile for institutional investors.

AfDB’s Room 2 Run transaction is one of the first transactions in this space to use a securitization sold to private investors to free up balance sheet capacity. The bank engaged in a synthetic securitization where they transferred the mezzanine risk on a $1 billion portfolio of existing loans to a private investor. The private investor was able to get the required yield on their slice of the transaction because the European Commission provided a guarantee on the senior mezzanine risk of the portfolio. In return the European Commission has asked AfDB to re-invest all the freed-up capital into renewable energy projects.

Looking forward, as more and more public, philanthropic, and private institutions look to engage in blended finance transactions, DFI’s capacity to pool assets and transfer risk as well as their expertise in emerging markets will be critical to the success of blended finance and must be optimized.