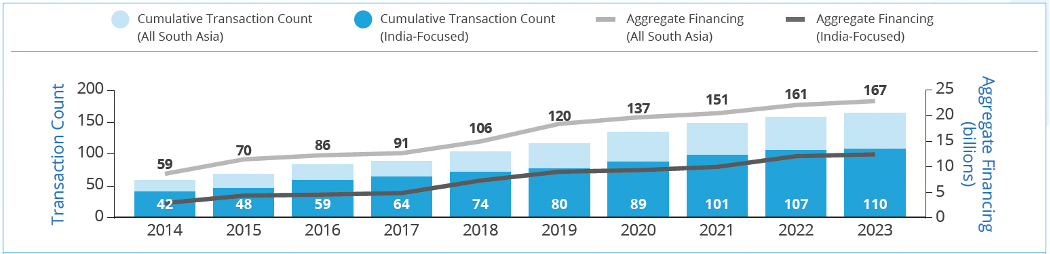

Figure 1: Market size and growth of blended finance in South Asia

The latest data brief from Convergence analyzes how blended finance approaches have been deployed in South Asia to date and presents insights from interviews conducted with industry stakeholders. This article provides a snapshot of the data brief, including opportunities and challenges for blended finance in South Asia.

Click here for the Blended Finance in South Asia data brief.

In the past two decades, South Asia has experienced significant economic growth. For instance, the region experienced a growth rate of 5.8% in 2023, with India accounting for approximately 70% of the region’s total economy and almost 75% of the population. Despite this success, South Asian countries continue to face major challenges, such as government debt, which averaged 86% of GDP in 2022 across the region. Moreover, some countries, such as Bhutan, Pakistan, and Sri Lanka, face weak private investment, with growth that has been negative or near zero. The region is also vulnerable to natural disasters, made more frequent and intense by climate change. Blended finance can play a role in addressing many such challenges by using concessional catalytic capital to de-risk private sector investment.

The Convergence Historical Deals Database (HDD) has recorded 167 blended transactions targeting South Asia in part or in full, representing aggregate committed financing of $23.5 billion. A large portion of both the deal count and aggregate financing has targeted India. To provide a more accurate picture of India’s influence on the data, the Blended Finance in South Asia data brief distinguishes deals between India (“India-focused deals”) and the remaining South Asian countries (“South Asia excl. India”) where appropriate.

Key takeaways from the brief

India is South Asia’s largest blended finance player by deal count and financing

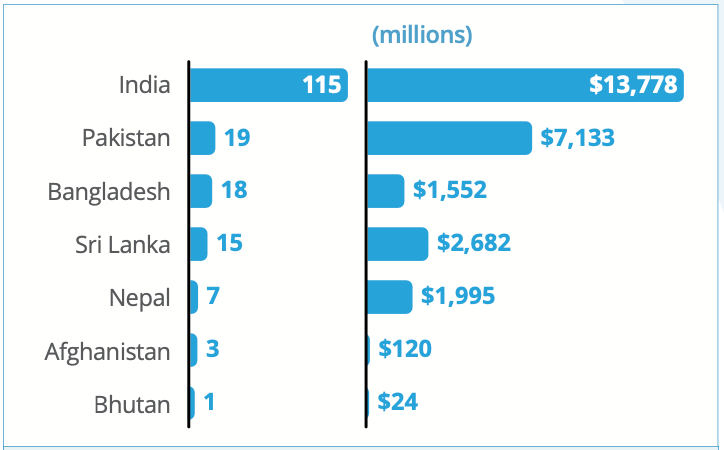

Given the size of its consumer market and the prominence of its economy within the region, India is the most active blended finance market in South Asia with 115 transactions, of which 110 transactions are India-focused, while the remainder are also active in multiple other South Asian countries. India is followed in deal count by Pakistan (19), Bangladesh (18) and Sri Lanka (15). While India accounts for 69% of blended finance transactions in South Asia, these transactions tend to be small and make up only 59% of aggregate financing in the region. Pakistan, on the other hand, accounts for only 11% of total South Asia transactions but 30% of aggregate financing.

Figure 2: Deal count and aggregate financing by South Asian country

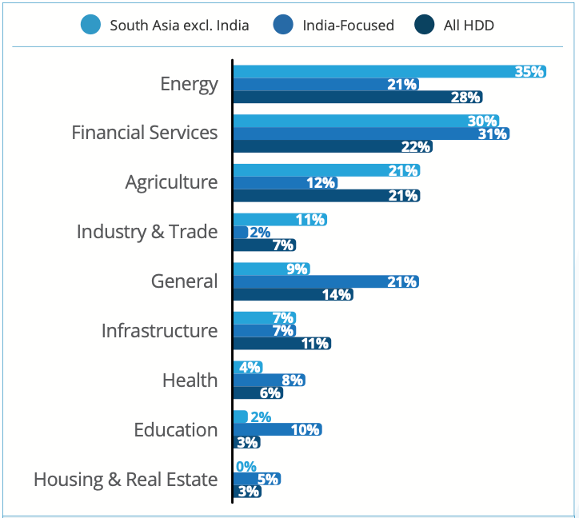

Energy and financial services most prominent sectors in South Asia

The top sector targeted by blended finance transactions in South Asia is energy. While demand for energy across South Asia has increased by over 50% since 2000, renewable energy use varies widely by country. For example, Afghanistan, Bhutan and Nepal have used small-scale solar and hydropower to bridge the gap between rural and urban energy access, whereas India remains dependent on fossil fuels, with coal supplying 44% of total energy consumption in 2020. Blended finance can help address the financing challenges associated with access to commercial capital for renewable energy by de-risking investment opportunities and crowding in private funding.

Secondly, compared to all HDD transactions, South Asia overall has a higher representation of blended transactions targeting financial services. According to the International Monetary Fund Financial Development Index, South Asia’s financial inclusion is behind its G20 and ASEAN-8 peers; in 2021, only 11% of adults in South Asia were borrowing from and saving with a financial institution. Many adults who do borrow turn to friends and family as a source of funds. Blended finance can help increase financial development by de-risking investments in inclusive financial institutions.

Figure 3: South Asia transactions by sector

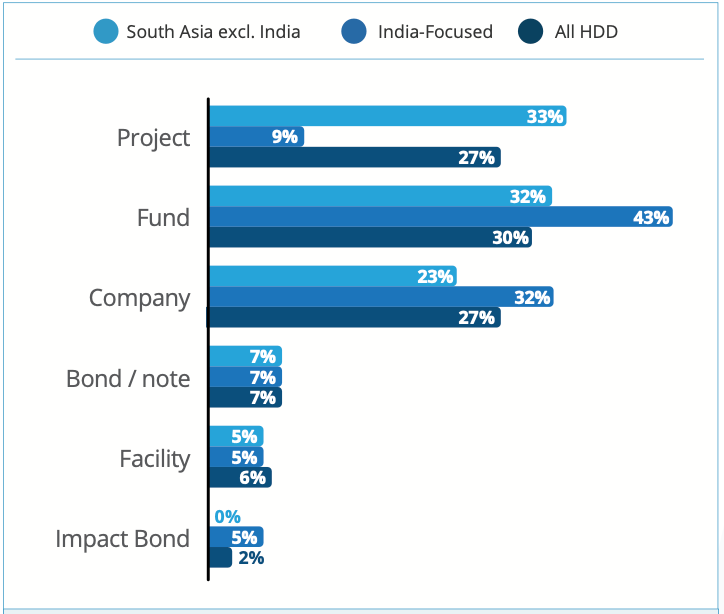

Projects predominant in South Asia excl. India; funds predominant in India

In South Asia excl. India transactions, projects make up 33% of the blended finance landscape, whereas in India-focused transactions, projects play a smaller role (9%). Meanwhile, funds play a larger role (43%) in blended transactions in India, and a smaller role (32%) in the rest of South Asia. The prevalence of funds among India-focused structures is likely related to the size of the Indian economy and its familiarity to portfolio investors who place money in funds. Other countries in the region may have more difficulty attracting fund investors, even with blending, in which case project finance offers another avenue. Single-asset financings of a sufficient size, credit enhanced through blending, can attract direct investors, especially in established asset classes such as energy.

Figure 4: South Asia transactions by blended vehicle type

Opportunities and challenges for blended finance in South Asia

Throughout our interviews with blended finance practitioners across South Asia, several themes arose regarding challenges and opportunities for blended finance in the region. The largest challenge noted is the cost of foreign exchange hedging, which can prohibit poorer countries from accessing capital markets. Inconsistent or archaic legal and regulatory environments is a second challenge that many interviewees spoke about. South Asia is hampered by outdated legal frameworks and highly bureaucratic systems that can lead to a lack of innovation in the financial sector. A third challenge is a lack of understanding of blended finance structures, leading to hesitancy by investors to provide funding towards these transactions.

With these challenges come opportunities to increase the use of blended finance in the region. Innovations from South Asian governments and regulators can help to incentivize private investors to participate in blended finance transactions and create an enabling environment. Some interviewees shared examples where governments could have positive impacts, such as through the creation of an overarching regulatory framework for infrastructure development in Pakistan, or the push for a sovereign credit rating in Nepal. A sovereign rating provides information on the background level of country risk that could affect that transaction. The presence of this benchmark allows better calibration of the amount of concessional support needed in a blended transaction to secure private sector interest and could reduce the need for concessional support.

There are also opportunities to increase the use of philanthropic capital to catalyze private investment in South Asia. Currently, regulations in India prohibit the use of corporate social responsibility (CSR) in blended finance structures, however CSR could be a potentially large pool of concessional capital. Meanwhile, there could be an increasing role in blended finance for family offices and high net-worth individuals.

Finally, blended finance can be used to close the Sustainable Development Goal (SDG) financing gap in climate-focused and social sectors. While the largest opportunities for blended finance in South Asia focus on areas of climate investments like energy storage, micro grids, cooling, and biofuels, there is untapped opportunity to mobilize private capital for health and education. Currently only a small portion of blended finance transactions in South Asia target social sectors such as health and education. Convergence found that scaling private financing into these sectors will require the development community to deploy catalytic financing to launch funds of funds to develop a broader investment ecosystem in the space.

Blended finance can be an effective tool in South Asia’s agenda for sustainable development. The region’s transition to net zero, the opportunities to update legal and regulatory frameworks to create an enabling environment for investors, and the largely untapped pool of philanthropic capital are some of many avenues where the region can benefit from blended finance.

For further information on Convergence’s methodologies, click here.

Become a member and read the full brief.