Latin America faces formidable challenges in maintaining access to capital against the backdrop of climate change and ecosystem degradation. Nearly $107 billion in additional investment is required per year in the region to support nature-based solutions (NbS) and align with the Rio Convention Targets1. Nature-based solutions play a vital role in maximizing the impact of capital invested in Latin America’s infrastructure and have high potential to contribute to the Sustainable Development Goals (SDGs).

AMPLO Impact Investing (Amplo)’s Blooming Roots Fund is designed to invest in gender inclusive NbS-aligned sectors in Latin America. Amplo is working with Grassroots Business Fund (GBF) and Andes Impact Partners (AIP), a spin-off of GBF, to design and operate the fund.

Feasibility study grant for the Blooming Roots Fund

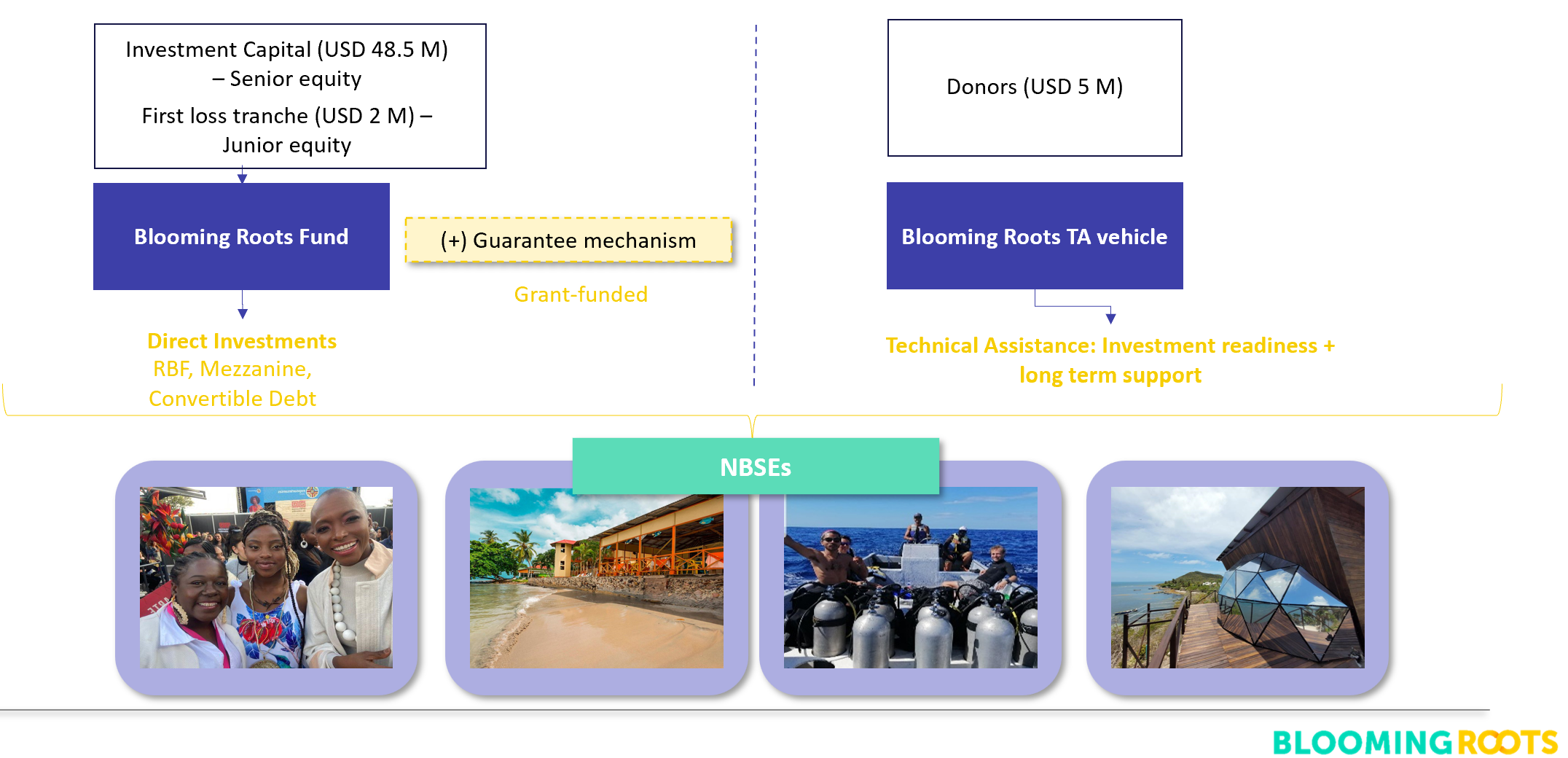

Convergence awarded a feasibility study grant to Amplo under the Gender-Responsive Climate Finance Window funded by Global Affairs Canada, for the design of the Blooming Roots Fund—a $50 million, blended fund that aims to invest in a diverse portfolio of for-profit NbS enterprises (NbSEs) focused on sustainable agriculture, sustainable tourism, health and personal care bio-products as well as nature-tech businesses that allow the scaling of portfolio companies in Latin America. The fund will invest in NbS-aligned sectors across Colombia, Peru, and Central America supporting gender-inclusive businesses that foster sustainable use of natural resources.

The Blooming Roots Fund employs a blended finance strategy that combines innovative and flexible financing and technical assistance (TA). The fund aims to utilize investment capital to make direct investment into NbSEs and offer first-loss capital along with a guarantee to reduce investment risk. TA will support investees to gain new skills and improve their financial performance and capacity to generate impact.

Targeting climate and gender

The Blooming Roots Fund aims to contribute to the development of NbSEs as a viable and long-term solution for addressing climate adaptation and mitigation and to bridge rural and gender gaps. The fund focuses on rehabilitating and strengthening the entrepreneurial ecosystem, targeting rural populations living in areas where economic activity relies on land use or exploitation.

TA will include opportunities to strengthen businesses’ environmental management, including the provision of necessary tools for implementing sustainable practices and enabling appropriately delivered NbS, such as support for carbon certification and payment for ecosystem services structuring. Additionally, investees will receive gender-focused TA allowing them to develop gender-inclusive company policies that will foster female leadership and skills development to close information, financial, and digital literacy gaps.

Through the fund, over 400 community members will gain access to increased income and improved knowledge tools with 50% expected to be women. The NbSEs supported through the fund aim to restore natural habitats, protect the ecosystems of 1,000 ha of land, and capture 27,855 tons of CO2 through carbon sequestration.

Challenges during the design process

In its original design, the fund aimed to primarily support smaller businesses, however managing many small investments proved costly and inefficient. To address this challenge the fund has developed a diversified investment strategy to pool resources from larger investments to support smaller ones. The fund uses a variety of long-term performance-based instruments, including revenue-based finance and mezzanine debt, and convertible debt or pure equity instruments for ecosystem enablers (innovation and tech-based businesses supporting NbSEs). Each investment is evaluated on a case-by-case basis to meet the investee’s needs.

Investors often perceive NbSEs and SMEs as high-risk investments. To mitigate this perceived risk, the Blooming Roots Fund has implemented risk reduction measures, including utilizing self-liquidating instruments, offering guarantees, and providing first-loss capital funded by grants. These mechanisms help reassure investors and make investment opportunities more attractive.

Data availability for benchmarking purposes can be limited, especially in the context of supporting NbSEs and SMEs. To meet this challenge, the fund developed their own benchmarking system leveraging data drawn from previous advisory work and a comprehensive baseline study conducted on the ground. Using this data they have gained valuable insights into how to effectively support target businesses, particularly with a gender-smart approach.

How Design Funding has helped to advance the solution

Convergence's Design Funding support to the Blooming Roots Fund has significantly advanced the fund’s efforts on multiple fronts. Design Funding has empowered Amplo to allocate more resources towards refining their structure and strengthened their fundraising endeavors by financially supporting their team's commitment. Feedback from Convergence has helped them enhance their investment thesis and refine their materials. Convergence’s support has also served as a compelling marketing asset for the fund, enhancing its credibility and appeal in the market.

The importance of blended finance

Creating a robust pipeline of NbSEs is key to the fund achieving its mission of driving long-term, positive social, environmental, and economic change. To this end, the Blooming Roots Fund’s blended structure is essential. Utilizing grant capital for investment readiness ensures that NbSEs are adequately prepared to meet the fund's investment criteria, leading to pipeline development, derisking, and proper implementation of sustainable business models within the realm of NbSEs. This proactive approach to pipeline development increases the likelihood of identifying viable investment opportunities and contributes to the fund's overall impact objectives.

The fund's blended structure derisks the typical challenges sustainable business models often face including market volatility, regulatory uncertainties, and limited access to capital. Guarantees and first-loss grants encourage private investors to participate while instilling confidence in NbSEs, enabling them to pursue innovative solutions without fear of failure.

Proper implementation of sustainable business models is equally as important as investment. The fund's TA equips NBSEs with the knowledge, skills, and resources needed to empower them to execute their business strategies while maximizing social, environmental, and financial impact. This approach fosters resilience and adaptability within NBSEs allowing them to navigate challenges and capitalize on opportunities in a rapidly evolving market landscape.

The way forward

Building on learnings from its initial pilot, conducted in the Providencia and Santa Catalina islands in Colombia, Amplo designed the Blooming Roots fund with the aim to expand its reach by implementing scalable and replicable strategies and further refine its investment approach to optimize the use of resources in the target areas for higher potential impact. The fund is currently completing its design and structuring activities and conducting stakeholder consultations.

The fund is also actively seeking alliances with organizations that share a commitment to sustainable development and have a proven track record of success in complementary sectors. They are currently exploring partnerships with organizations like Cacao for Development, whose technical assistance program in the cacao and complementary crops value chain has garnered positive results in the region. Through collaboration with similar organizations the fund aims to leverage their expertise, networks, and resources to amplify impact, expand reach, and drive meaningful change in target communities and sectors.

1. State of Finance for Nature 2023, United Nations Environment Program.

Have a blended finance solution at the intersection of climate change and gender equality? Apply for funding from our Gender-Responsive Climate Finance Design Funding Window, which awards early-stage grant funding for the design and launch of innovative blended finance vehicles focused on climate change and gender equality in emerging markets globally.

To see what Convergence has supported to date, review our Design Funding grantee portfolio here.