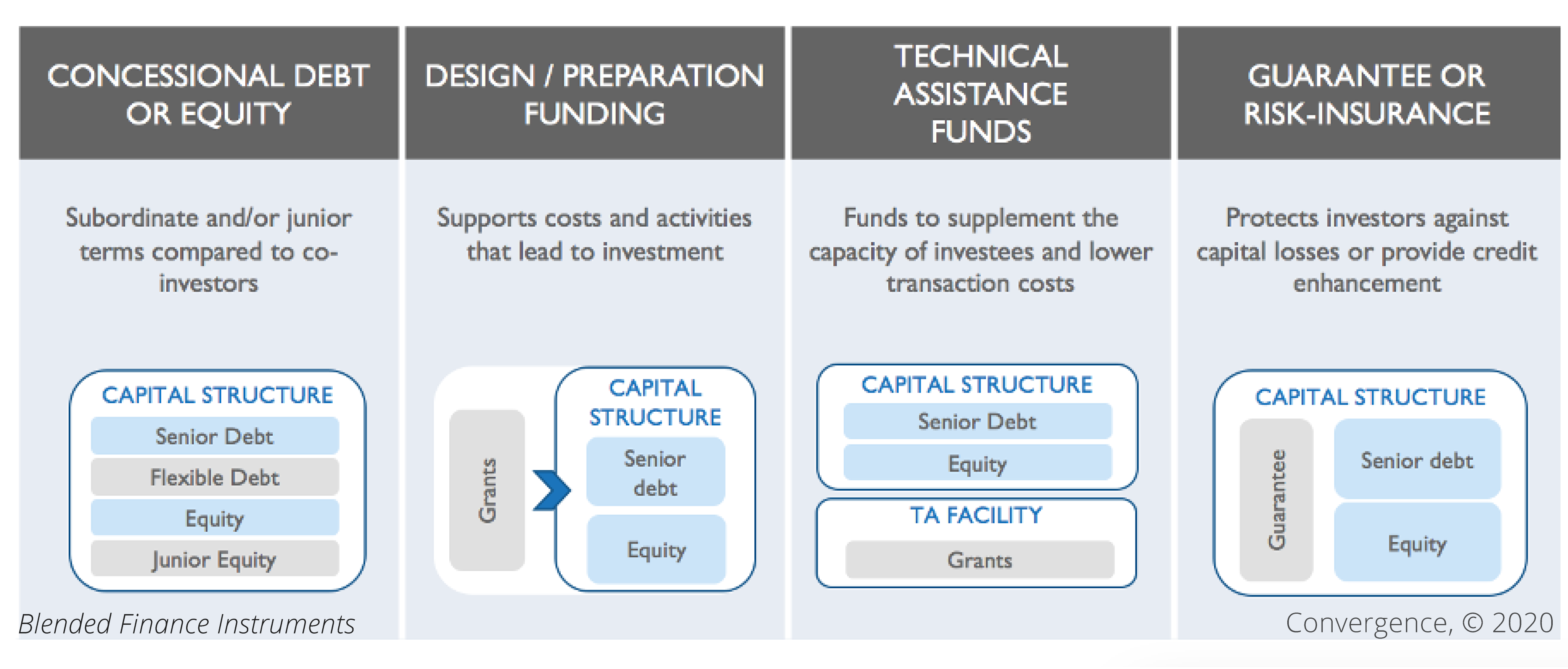

COVID-19 has pushed many of us to reimagine the way we operate and act on ideas calendared for later. This was true for us at Convergence. Earlier in March, in response to travel bans, Convergence launched a series of virtual trainings to maintain momentum in building capacity in institutions eager to employ blended finance. Our first virtual seminar series, A Closer Look at Blended Finance Instruments, included eight training sessions on the use of guarantees, technical assistance, design and preparation-stage grants, and concessional capital in blended finance structures. These trainings attracted over 400 attendees from various member and non-member organizations, including development agencies, financial intermediaries, commercial investors and deal sponsors.

Here are some high-level takeaways from our trainings on blended finance instruments:

Guarantees are popular, but no one-size-fits-all solution

Our first training session on guarantees reached full capacity in less than a week, demonstrating the popularity of this blended finance instrument. According to Convergence’s latest State of Blended Finance report, guarantees have been consistently used in the market over time, appearing in a third (33%) of transactions, along with risk insurance.

High perceived risks are a major barrier to increasing private capital investment in many sectors and geographies. Guarantees help shift the risk of capital loss to the guarantor, which increases the mobilization of private capital in regions where the perceived risks rather than real risks deter private investors from committing their capital. However, while guarantees reduce the loss-given-default, they do not alter the probability of default that can limit investor engagement. Further, while many regulated banks and insurance companies require irrevocable and unconditional guarantees to qualify for capital relief, guarantees are issued with varying terms and conditions – not all of them being irrevocable and unconditional. And, guarantees do not substitute for other instruments such as loans, instead, backstop such instruments adding complexity to a transaction.

While guarantees are an important instrument for mobilizing additional private sector financing for developing countries, they are not a one-size-fits-all solution.

Blended finance draws out the complementary skills in partnerships

Some of the most frequently asked questions included: “Who initiates blended finance structures?” and “How do these institutions find each other?”

The answer was: it is a team effort. Various guest speakers acknowledged that forming the necessary partnerships is an important first step. Designing a blended transaction requires two distinct skill sets, one being financial expertise to develop the right financial structure with appropriate risk-return profiles for funders and investors, and the other, sector-specific expertise to determine interventions that can yield the desired development impact. One speaker aptly described the forming of their partnership with another institution as “a dance.” Consider CARE Enterprises Inc. partnering with the International Trade Center and Bamboo Capital Partners to launch the CARE-SheTrades Fund or Climate Policy Initiative partnering with Albion Capital to develop a new Green FIDC (Portuguese for Green Receivables Fund) - an organization with sector-specific knowledge needed to partner up with an institution bringing in the financial expertise.

Leverage ratios spark vivid discussions

In the last seminar “Blending with Concessional & First-loss Capital,” it became clear that leverage ratios remain a controversial topic in blended finance as there is yet to be a standardized method for calculation, or a common view on their value as a metric. Based on Convergence’s analysis of 157 historical blended funds and facilities, leverage ratios average at 1:5. When assessing by region, Convergence presented that average leverage ratios for Latin America have historically been higher than those for Sub-Saharan Africa. These points sparked a vivid discussion among participants, some of who expressed (i) importance for transparency in methodologies used to calculate the leverage ratio (see this blog and this video for details on the methodology we applied); and (ii) that even a leverage ratio of 1:1 can be a worthwhile goal, especially in sectors where it is more difficult to create revenue lines and in geographies deemed risky by commercial investors.

There is demand for more technical discussions on designing blended transactions

The process of structuring a blended transaction and reaching first close often takes longer than a year. Arguably, even the best guest speakers cannot summarize months of negotiations and design tweaks in a 15-minute presentation. The good news is we have captured the details of structuring a transaction in our case studies, covering various models, from development impact bonds to debt funds such as the Medical Credit Fund. Therefore, we frequently referred participants to our Resource Library for a deep dive into structuring transactions.

Having concluded this seminar series on blended finance instruments, we have now launched a new seminar series: “Blended Finance in Select Sectors.” Check out our Training Page to register.